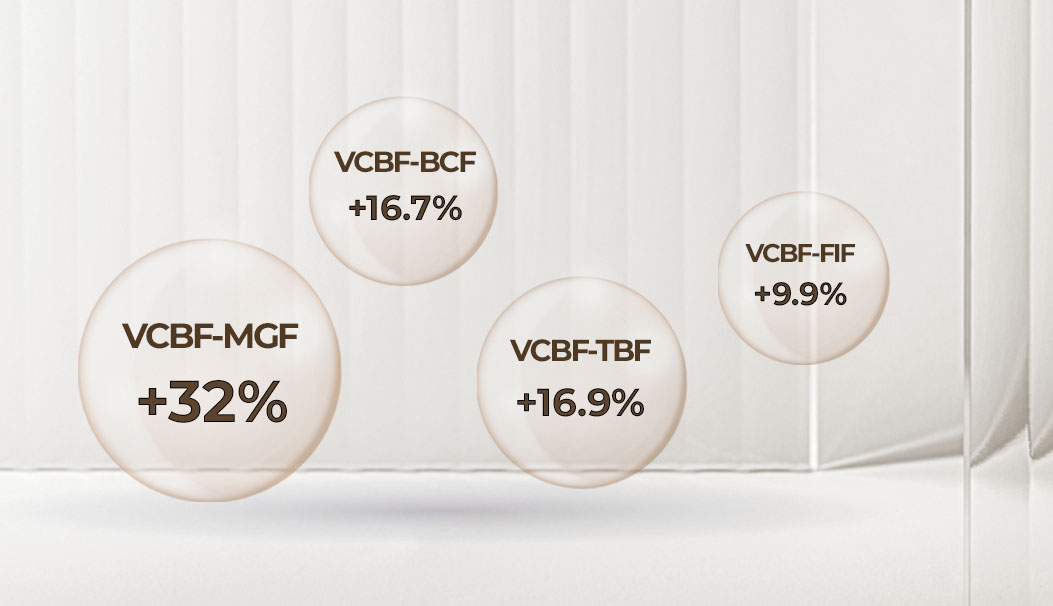

The stock market saw a lot of turbulence because of the many and wide-ranging events and occurrences during the year. However, in general 2023 was still positive for the Vietnamese stock market and the VN-Index increased by 12.2% yoy. Nevertheless, the open-ended funds of Vietcombank Fund Management (VCBF) still stood out with impressive performance by out-performing the VN-Index. Notably, VCBF-MGF was the best performing fund in the market in 2023.

The Government’s policy to stabilize the economy, notably its expansionary monetary policy which led to the fastest decrease in the banks’ interest rates in many years, supported the stock market. This positive development also led to impressive growth of VCBF’s open-ended funds. This was a notable achievement because the funds already had had outstanding results in 2022 with VCBF’s open-ended funds amongst the funds with the smallest losses in the market in that year.

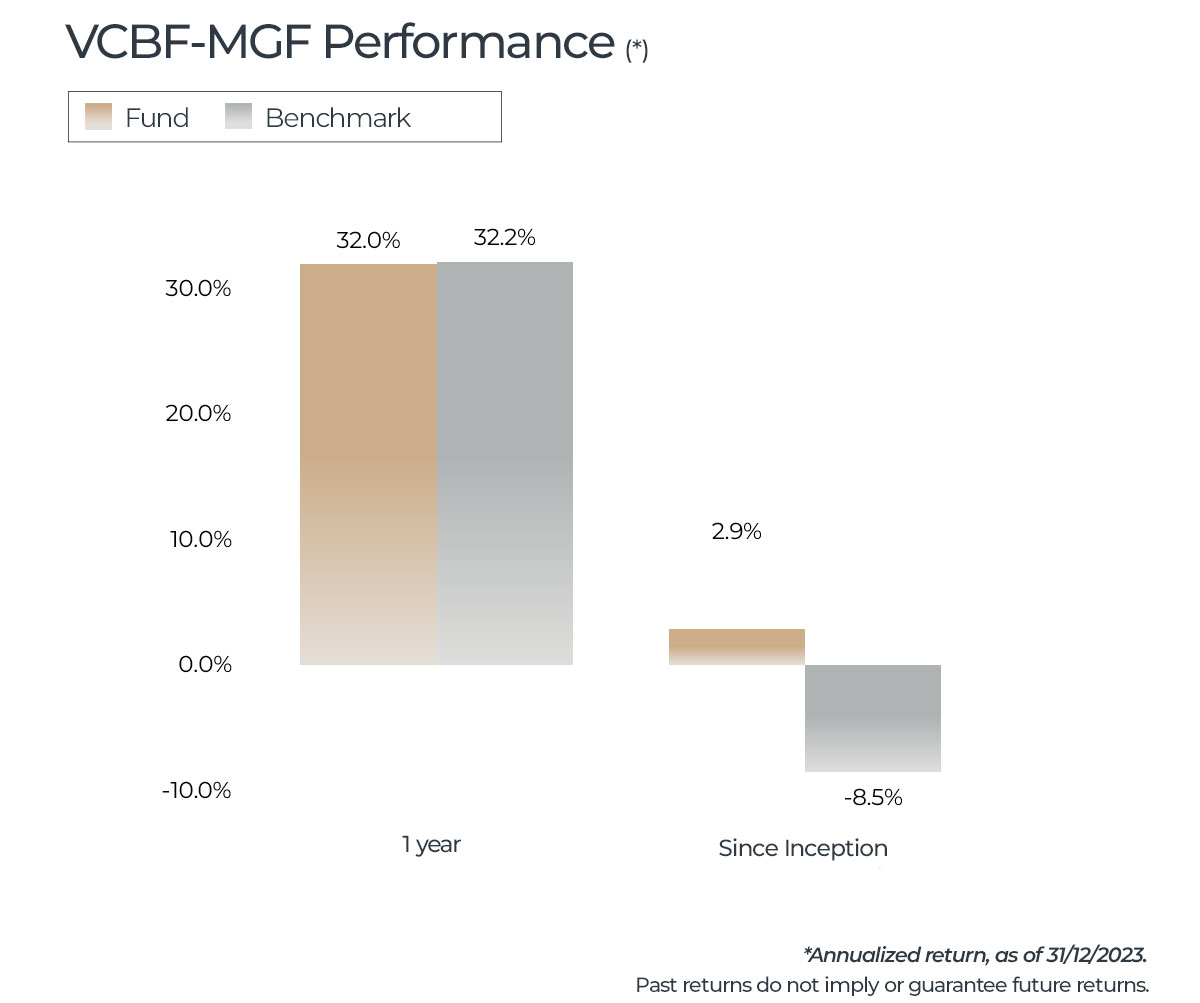

VCBF Mid-cap Growth Fund (VCBF-MGF) was the best performing fund in Vietnam in 2023, increasing by 32.0% over the year. Consequently VCBF-MGF recovered its losses from 2022 but also gave investors good returns in 2023. The fund was launched when the market peaked at about 1,500 points and was still trading at around 1,100 points at the end of the year, so it is striking that the fund is trading above its launch price of VND10,000 per Unit. In fact, the fund has provided much better returns since inception in December 2021 than other funds established at the same time and is also above its benchmark, the VN-70. The fund invests mainly in high-growth stocks, the majority of which are mid-cap stocks.

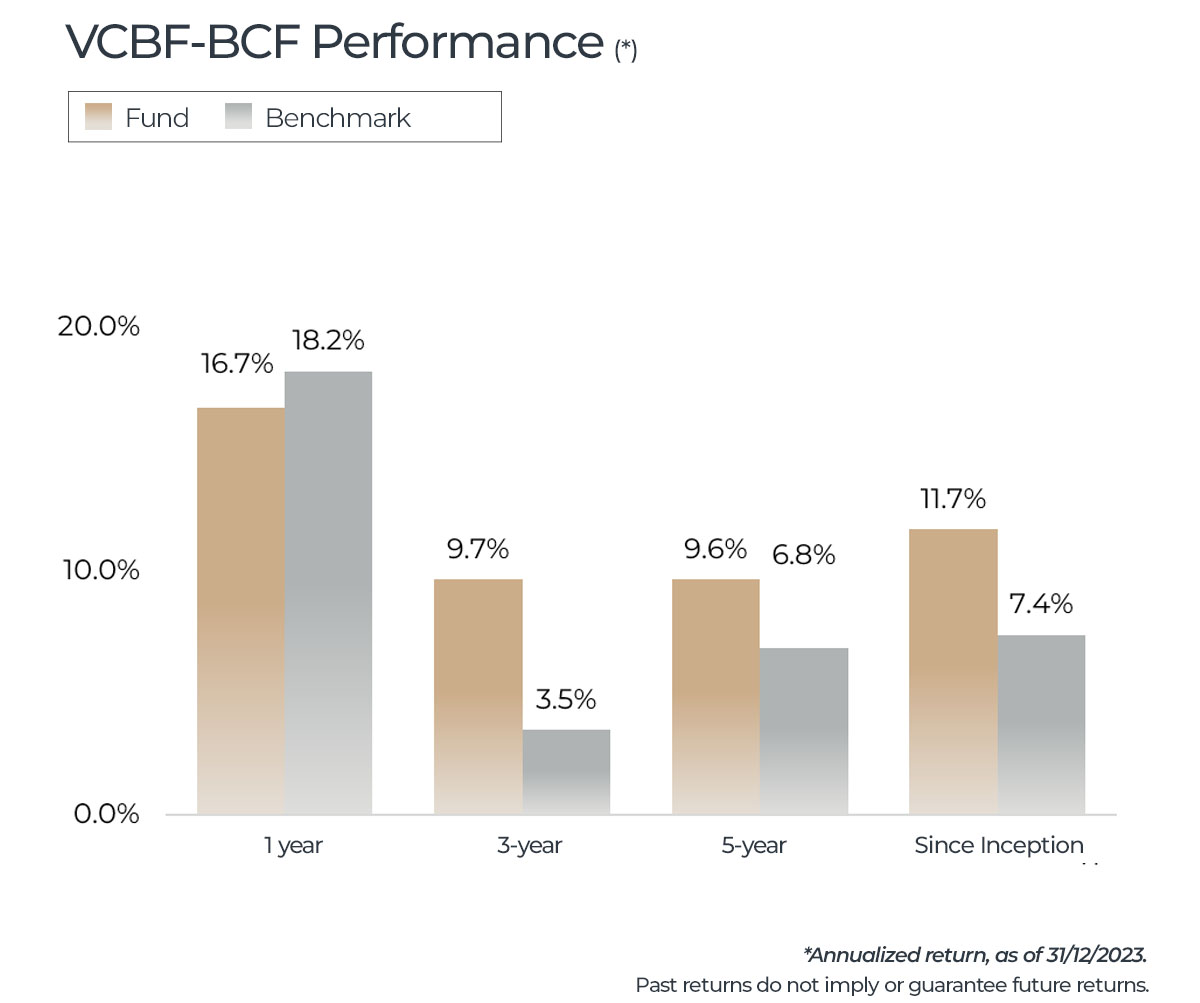

VCBF Blue Chip Fund (VCBF-BCF) made a return of 16.7% in 2023. The fund invests in stocks with a high market capitalization and with high liquidity. In comparison, the index of the high-cap stocks, the VN-30, increased by only 12.6% due to the selling pressure of foreign investors. The fund’s performance was thus a notable achievement, especially as it had fallen by 18.1% in 2022 against the market falling by 32.8%. Since the fund’s inception in 2014, it has made an average return of 11.7% per year, ranking second best amongst the funds established since 2014. Despite having been through many phases of the stock market, VCBF-BCF thus still offers attractive performance over the long term, not only in comparison to bank deposit rates but as it has generated higher returns since inception than three-quarters of the stocks in the VN-30 index.

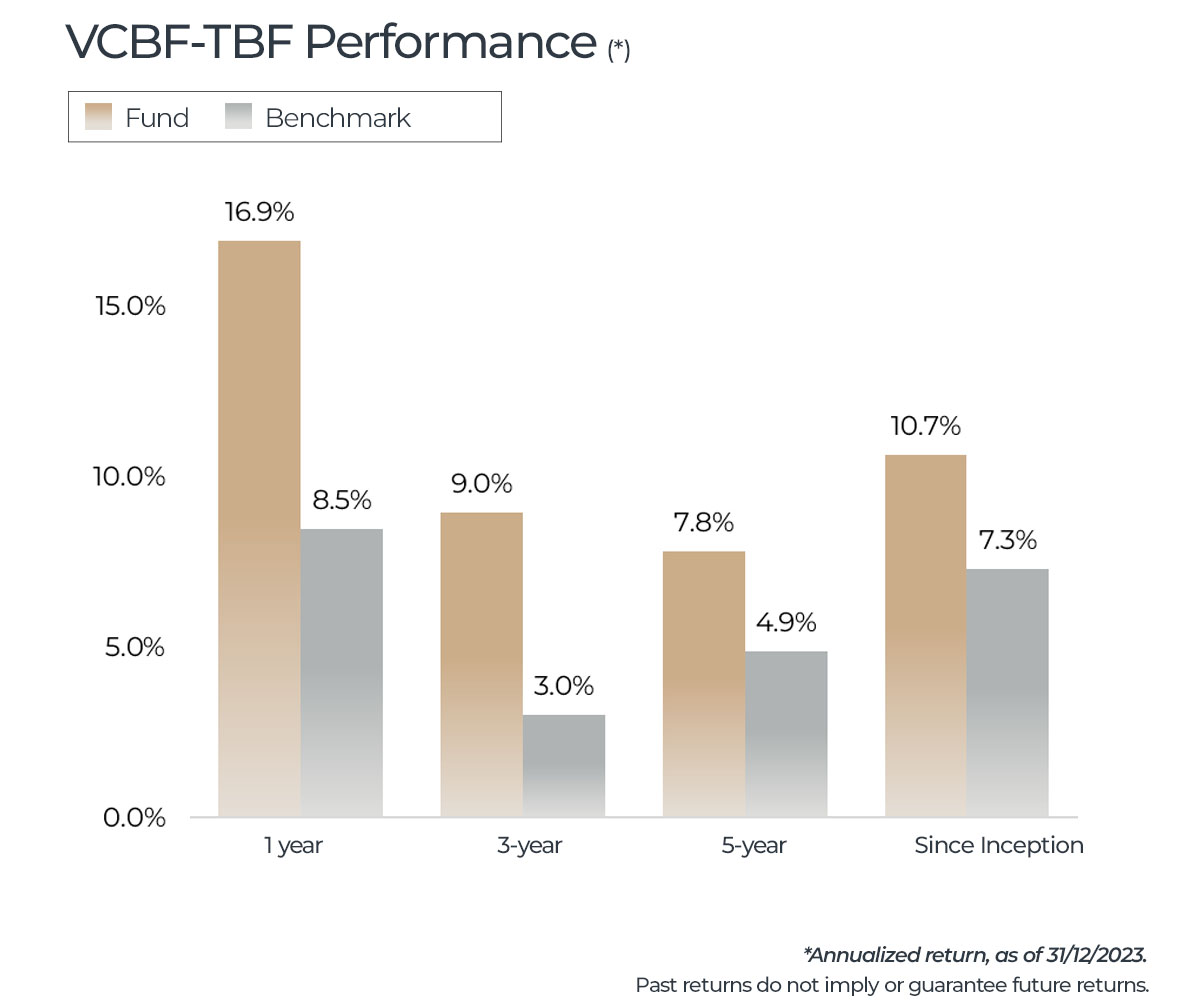

VCBF Tactical Balanced Fund (VCBF-TBF) had a return of 16.9% in 2023. VCBF-TBF can strategically adjust the allocation of its assets into stocks and corporate bonds with good credit quality. The fund benefited from the recovery of both markets and had the second highest return of the balanced open-ended funds in the market in 2023. The fund’s benchmark is the average of the VN-Index and the 10-year Government bond yield: the fund out-performed its benchmark by 8.4% in 2023. The fund has made an average return of 10.7% per year since inception in December 2013.

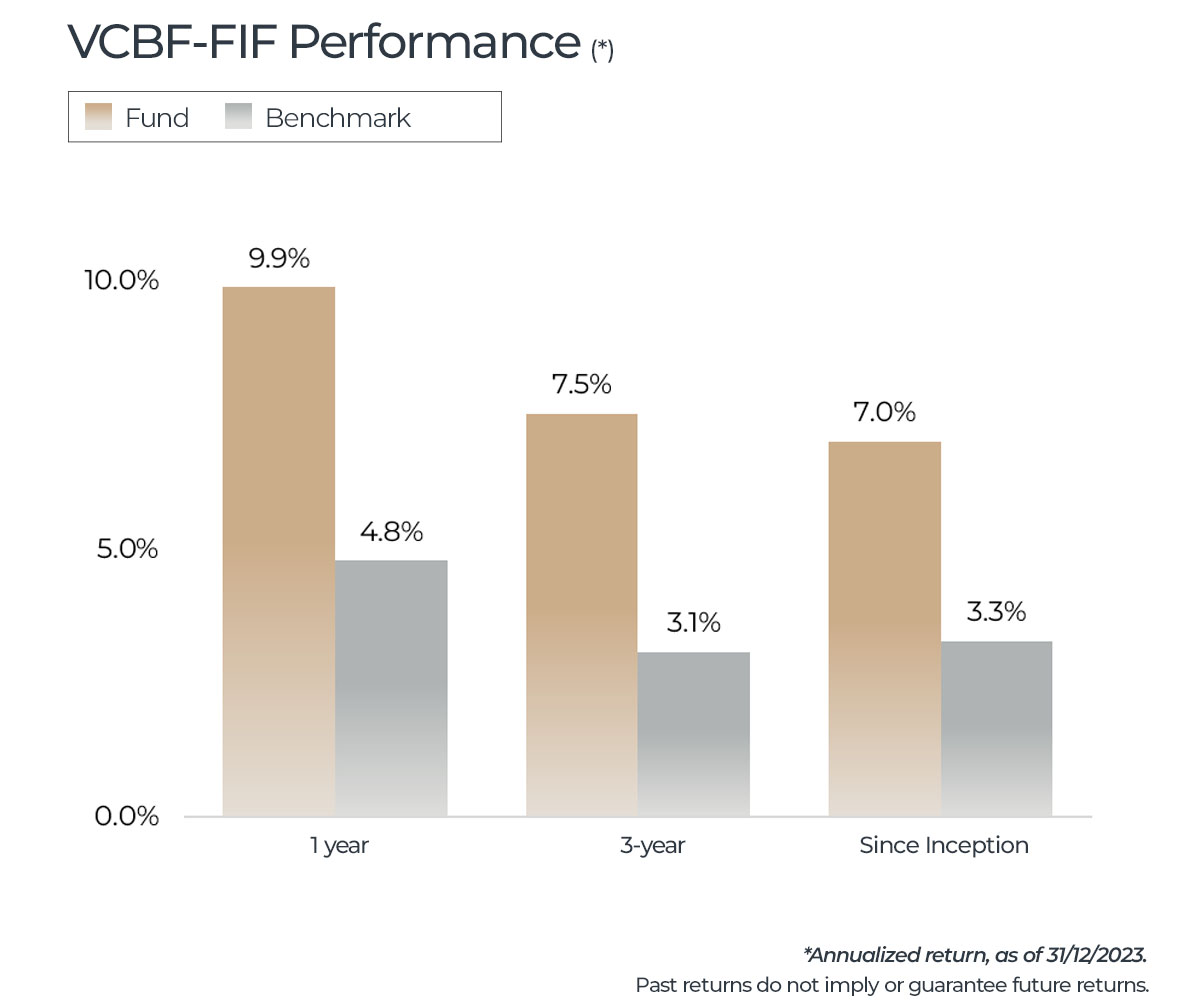

VCBF Fixed Income Fund (VCBF-FIF) made a return of 9.9% in 2023 following the recovery of the corporate bond market, which was the best return the fund since inception. The bonds in which the fund invests are carefully selected by VCBF’s investment team. As a result, all bond payments were made in time and in full to the fund when they became due while many corporate bond issuers in the market faced liquidity issues and had to reschedule the payment obligations. The fund’s benchmark is the 10-year Government bond yield, which the fund exceeded by 5.1% in 2023. Since inception in August 2019, the fund has achieved an average return of 7.0% per year.

In VCBF’s opinion, Vietnam’s stock market outlook in 2024 will continue to be positive. This is because of positive macro-economic developments, growth of corporate earnings and the loose monetary policy will continue; the prospect of the stock market being upgraded to emerging market status will support the market. That said, businesses will see uneven developments, so that stocks in the same sector will have their own story lines and have different growth potentials. Consequently, smart stock selection will always be an important factor in the funds’ returns.

VCBF will continue to maintain a high proportion of its investments in stocks with high growth prospects and with attractive valuations. These investments and the readiness to utilize growth opportunities in the market will benefit the long-term growth of the funds.

VCBF has four open-ended funds which cover the entire scope of investors’ investment requirements. By meeting these requirements by choosing which open-ended funds, adjusting their holding periods and keeping the return/risk relationship at acceptable levels, we believe you will find the right combination for your specific financial goals. VCBF is always a reliable partner for you to deposit your family savings to make your investments.

If you’re wondering when the best time is to invest, our advice is: “The best time is now”. Financial markets are volatile and no one can predict tomorrow’s trends accurately. So choose long-term investing and keep patient. This lets you take advantage of the benefits of long-term growth while minimizing the impact of short-term volatility. Trust in your long-term strategy and start your investment journey with us with optimism and consistency!

For your convenience, you can use the on-line platforms, VCBF Mobile, VCB Digibank, Fmarket and MoMo, to make and monitor your investments in VCBF’s open-ended funds!

|

|

|

|

View More

You want to invest? Please fill the form: